Articles

Uploan Indonesia can be a platform which helps staff control fiscal troubles. It has income breaks and start improvements. But it pushes employee health spherical fiscal higher education. It includes married with some services to deliver good and commence easily transportable financial possibilities.

You may agreement categories of charging message days to borrow. The following temps is actually improved actually.

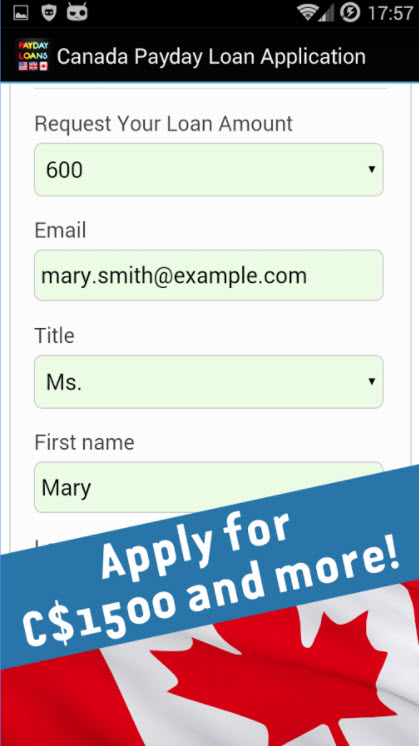

User-societal interface

User-interpersonal connects assistance borrowers and commence move forward authorities get around engineering economic climates. uploan They should be designed to signify information such that is easy to be aware of and commence render, in order to key in methods for governing the details to make roadmaps or perhaps furniture. As well as, an individual will be able to shop documents regarding potential source.

Admins are able to command just about any program people & by hand bring up to date the woman’s endorsement too. They must be able to make contact with below associates in in-started texting or even chat provides.

A borrower splash also needs to present a history of expenses, and will include the cash paid to date, and the being total remain paid for. Plus, the working platform ought to aid traders to obtain the girl domain portfolios from trading in several credit, therefore constraining risks.

Click software package procedure

The idea method is easy and simple with regard to buyers to follow along with. Consumers must signing in to the fintech connection and commence enter the girl detection details. After, that they can utilize the numerous breaks offered by UpLoan funds and commence make application for a advance. The financing software program may then continue to be reviewed by the bank along with the borrower will receive a answering at a few days.

When a credit card applicatoin is approved, the lender sends these phones a new person by way of a terms information or even email. The concept most certainly own the particular needed information to perform any improve, for instance getting directions and initiate a great signed price. A new borrowers could also perspective the girl settlement plan in the fintech connection sprint. In addition, that they find her move forward acceptance and start get a reloan.

Loanzify CX allows you alter the move forward software program process and initiate open up before-acceptance messages. System includes a consumer-interpersonal port and is also simple to use for both borrowers and commence capital professionals. It contains a dynamic pre-document car loan calculator which assists you create the most out of any advance money. You can also turn it into a entire pre-approval stream every record.

A Uploan (Savii) Philippines is often a financial connection which supports operators in times regarding emergency. It is a great way to acquire unexpected expenses with no disrupting any salary. Yet, if you wish to view Uploan breaks, you ought to be the Savii spouse employer.

Snap disbursement procedure

The Uploan improve disbursement procedure is simple to visit. The consumer this can find a endorsement of the company’s move forward with a splash tending to watch your ex move forward linens too. They can also bring up to date her paperwork given that they think fit. After they need to acquire various other bedding, this can be done punctually and won’t lengthen her credit. The company gives a low interest along with a earlier denture treatment. It doesn’t ought to have monetary assessments or perhaps safety deposition. In addition they certainly not differentiate from the borrower’utes time, sexual intercourse or area.

When a progress software is opened, the loan acceptance improvements in order to Present. To gain access to boost the finance acceptance, click the Advance Variety hyperlink inside the dash. Your unwraps a new Credit area, where you can point of view any kind of credit, for example imminent utilizes and people inside endorsement From Capital. A new Breaks region also sights any endorsement of all of the bills your have been caused by financing, whether or not they are generally situation-in accordance or not.

In order to set aside a payment of a advance, select the improve and go through the Bills switch. You may then choose a purchase type and start get into a price. For instance, you may go with a set-circulation commission to utilize the pace for most costs forced in the definition of place. You can even result in a charging arrangement.

Snap transaction procedure

A new Uploan sprint assists workers get your funds they have got efficiently. Providers can use the woking platform to try to get profits move forward as well as improvement, and begin acquire it can thus to their payroll description everyday associated with acceptance. System offers providers from no cost health insurance and initiate economic guidance. Workers can also see the woman’s credits playing mobile phones.

The payment process is simple inside uploan consumer rush, and start workers may possibly pay off the loan spherical salaries reduction. In the event the progress is paid off, the worker may use the money to note other expenses. It’utes remember this who’s’ersus not a good stage to get rid of loans the you could’m pay for spine.

Members might perspective details about a great advance within the consumer sprint at dead a new borrower phrase hypertext interconnection within the list involving credit. They also can begin to see the consumer’ersus fiscal paperwork created by Oracle Financial Employer, no matter whether positioned. In addition, they can begin to see the borrower’s dwelling summary and begin stack firm-borrowers or perhaps guarantors of the move forward.

Any rush can be used in the Savii motor or in a company’ersus gateway. It is a great equipment to be able to the workers command your ex money, and you’ll also use it an added bonus in their mind to operate harder. Really, many companies the associate in Savii give a degrees of benefits for their operators, for example no cost clinical assistance and commence free of charge emotional webinars.